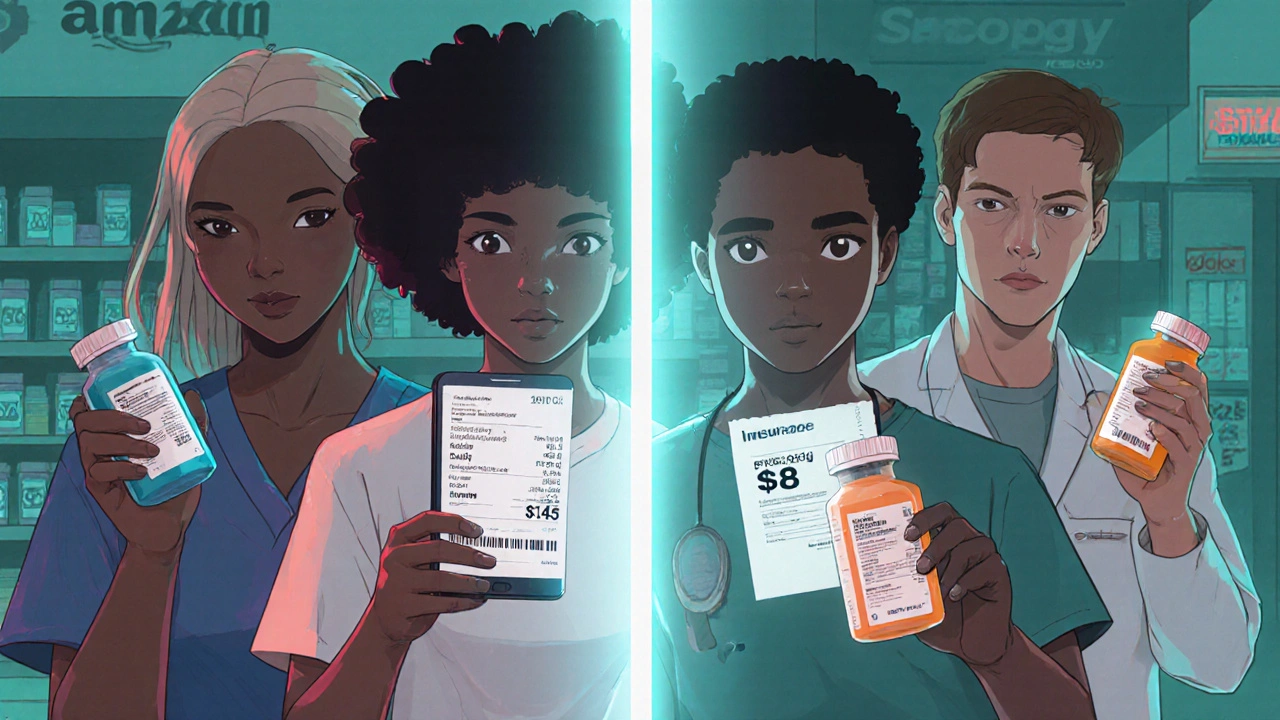

Insurance vs Cash Pay: What You Really Save and Who It Helps

When you pick up a prescription, you’re often faced with a simple but confusing choice: pay through insurance, a system that spreads healthcare costs across a group to lower individual payments or pay cash, the direct, upfront price without using coverage. It sounds straightforward—until you see your bill. Sometimes, your insurance copay is $40. Other times, the cash price is $15. Why? Because insurance doesn’t always mean cheaper. Many people don’t realize their plan’s negotiated rates, deductibles, or formulary restrictions can make paying cash the smarter move. This isn’t a glitch—it’s how the system works.

The real difference between insurance vs cash pay, two ways to cover the cost of medications comes down to pricing transparency and your personal situation. For example, if you’re on a high-deductible plan and haven’t met your deductible yet, every dollar you spend on meds counts toward it. Paying cash might skip that step entirely. Some pharmacies even offer discount programs—like GoodRx or manufacturer coupons—that drop the price of drugs like valsartan, levothyroxine, or generic warfarin below what your insurance charges after copays. And it’s not just about the price tag. Cash pay often means no prior authorizations, no formulary delays, and no surprise charges later. You know exactly what you’re paying, right then and there.

But cash isn’t always better. If you’re taking multiple meds every month, insurance can cap your total spending through out-of-pocket maximums. Once you hit that limit, your plan covers 100% of what’s left. For chronic conditions like inflammatory bowel disease, hypertension, or HIV, where you’re on long-term therapy, insurance often wins over time. Still, many patients don’t check their options. They assume insurance is the default—and end up overpaying. The truth? You’re allowed to ask for the cash price even if you have insurance. Pharmacies are required to tell you which option is cheaper. It’s not a secret. It’s your right.

What you’ll find in the posts below isn’t just theory. It’s real-world comparisons: how generic Lasix costs less cash than your copay, why Retin A users save hundreds by paying out-of-pocket, and how Super Viagra and Valif buyers cut costs by skipping insurance entirely. You’ll see how ferrous sulfate, cefpodoxime, and zestoretic prices vary wildly depending on payment method. These aren’t edge cases. They’re everyday choices people make to take control of their healthcare spending. No jargon. No fluff. Just what works—and what doesn’t—when you’re paying for meds.

Direct-to-Consumer Generic Pharmacies: How Much You Really Save vs. Insurance

Direct-to-consumer pharmacies can save you hundreds on expensive generics - but for common drugs, your insurance often beats cash prices. Here’s how to know which option is right for you.

Continue Reading