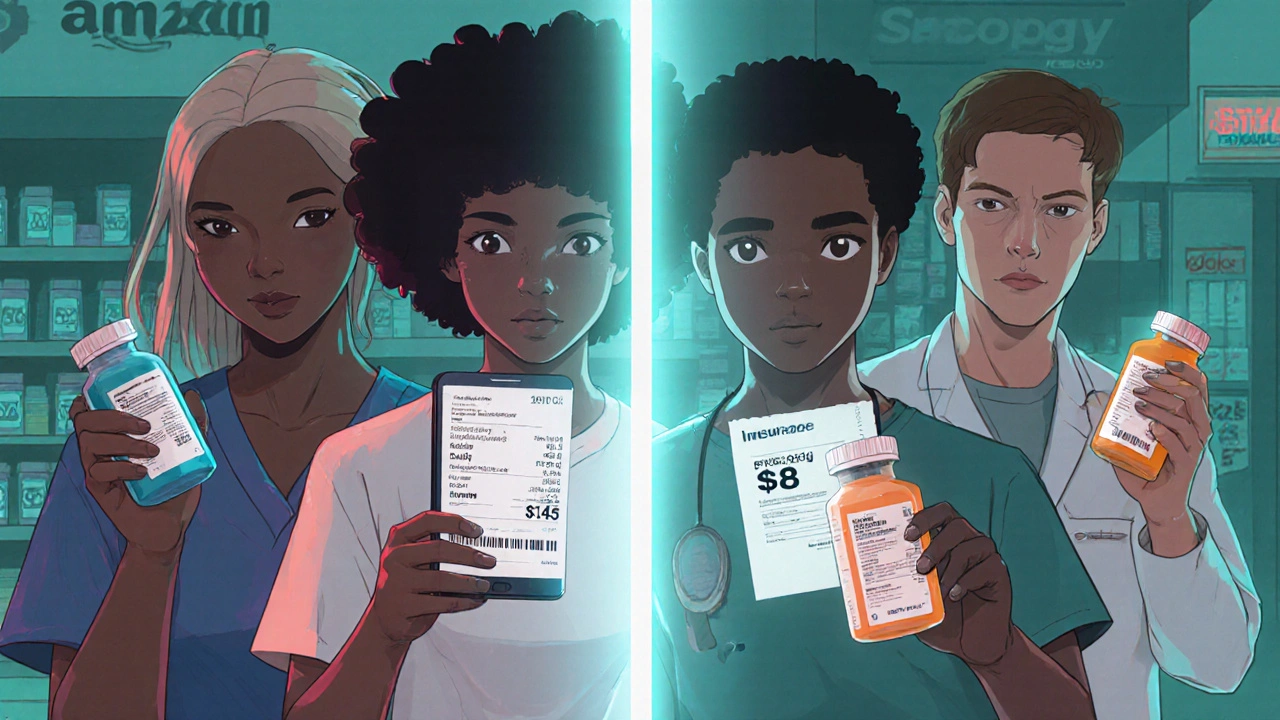

What if you could buy your monthly blood pressure pill for $3 instead of $45 - even if you have insurance? That’s not a fantasy. It’s happening right now at direct-to-consumer (DTC) pharmacies like Mark Cuban Cost Plus Drug Company, Amazon Pharmacy, and Costco. But here’s the catch: sometimes, your insurance still beats the cash price. And sometimes, the drug you need isn’t even available online. This isn’t about choosing between good and bad. It’s about knowing when to walk away from your insurance card and when to keep it in your wallet.

How DTC Pharmacies Actually Work

Direct-to-consumer pharmacies skip the middlemen. No pharmacy benefit managers (PBMs). No rebates hidden in contracts. No surprise price hikes after your insurer negotiates a deal you never see. Instead, these companies sell generic drugs at cost plus a flat fee - usually 15%. Mark Cuban’s Cost Plus Drug Company, for example, lists exactly how much they paid for each pill and adds their markup. Transparency like this is rare in U.S. pharmacy pricing. Amazon Pharmacy, Walmart, Health Warehouse, and Costco have jumped in too. They’re not just competing with each other. They’re competing with your local CVS or Walgreens - and often winning. But only if you know where to look.When DTC Saves You Big Time

The biggest savings come with expensive generics. These are drugs that cost hundreds of dollars a month under traditional insurance models - even if they’re off-patent and made by multiple manufacturers. Think: medications for rare conditions, certain cancer treatments, or complex hormonal therapies. A 2024 study in the Journal of General Internal Medicine looked at the top 50 most costly generic drugs in Medicare Part D. For these, DTC pharmacies saved patients an average of $231 per prescription. That’s a 76% drop in out-of-pocket cost. One patient paying $380 for a 30-day supply of a rare generic found the same drug at Mark Cuban’s pharmacy for $89. Another paid $512 at their local pharmacy and bought it online for $92. Amazon Pharmacy had the lowest price on 47% of these expensive generics. Mark Cuban’s company came in second at 26%. Costco and Health Warehouse split the rest. If you’re on a high-deductible plan or paying cash because you’re uninsured, this is where DTC pharmacies shine.When Insurance Still Wins

But here’s the twist: for common generics - the kind millions take daily, like metformin, lisinopril, or atorvastatin - the savings shrink. The same study found median savings of just $19 per prescription. That’s still a 75% drop from retail, but not always better than what your insurance gives you. CVS Health’s own research, published in JAMA Network, looked at 79 neurological generics. They found that for most of them, insured patients paid less out-of-pocket than they would if they bought the same drugs cash at DTC pharmacies. Mark Cuban’s pharmacy didn’t carry 46 of those 79 drugs. For the ones it did, only two were cheaper than what patients paid through their insurance. Why? Because insurers negotiate deep discounts with PBMs. Even with copays, your plan might charge you $5 or $10 for a 30-day supply. If you pay cash at Amazon, you might pay $12. That’s not a win. That’s a loss.What You Can’t Get Online

One-fifth of the most expensive generics aren’t available anywhere on DTC platforms. Not Amazon. Not Mark Cuban. Not Costco. Not Health Warehouse. That means if you’re taking a specialty medication - say, a generic version of a complex biologic or a rare hormone replacement - you’re stuck with your insurer or local pharmacy. No amount of price shopping will help. The drug simply isn’t stocked. And because DTC pharmacies don’t carry everything, you can’t rely on them as your only source. This isn’t a flaw. It’s a reality. These companies focus on high-volume, high-savings drugs. They don’t stock niche medications because the demand is too low to justify inventory costs.

Who Benefits the Most?

You’re most likely to save with DTC pharmacies if:- You’re uninsured or underinsured

- You have a high-deductible health plan and haven’t met your deductible yet

- You’re paying for medications not covered by your plan

- You’re taking one or two expensive generics

- You’re willing to spend 10-15 minutes comparing prices across platforms

The Price Shopping Trap

Here’s the hardest part: you can’t just pick one DTC pharmacy and call it a day. There’s no single app that shows you the cheapest price across all options. You have to check Amazon, Mark Cuban’s site, Costco, Walmart, and Health Warehouse - separately - for every single drug. One person managing three chronic conditions might need to check five platforms for five different prescriptions. That’s 25 price checks every month. And prices change weekly. A 2024 advisory report from Advisory Board called this a “time-consuming process with financial tradeoffs.” It’s not just about money. It’s about your mental energy. If you’re juggling work, kids, or aging parents, do you really want to spend hours hunting down $12 savings on a cholesterol pill?Costco Is the Hidden Champion

If you want the easiest win, skip the online hype. Go to Costco. Their cash prices for common generics are often lower than any DTC pharmacy - and you don’t need a membership to use their pharmacy. You just need to walk in. According to USC Schaeffer Center data, 90% of the most commonly prescribed generics in Medicare Part D cost less than $20 for a 30-day supply at Costco. That’s cheaper than most insurance copays. Costco’s model is simple: they buy in bulk and pass the savings on. No markup. No fluff. No website to navigate. Just a pharmacy counter and a price tag you can read.

What Should You Do?

Stop thinking of DTC pharmacies as a replacement for insurance. Think of them as a tool - like a coupon or a cashback app. Here’s your action plan:- Check your insurance copay for each generic you take. Write it down.

- Go to GoodRx or SingleCare and compare those prices to what DTC pharmacies charge.

- For expensive generics: compare Amazon, Mark Cuban Cost Plus Drug Company, and Health Warehouse. One of them will likely be the cheapest.

- For common generics: check Costco first. Then compare Walmart and Amazon.

- If your drug isn’t available on any DTC site, stick with your insurer.

- Don’t switch unless the savings are at least $20 per month. Time is money too.

The Bigger Picture

DTC pharmacies didn’t come to fix the broken U.S. drug pricing system. They came to exploit its gaps. They’re not the hero. They’re the workaround. They’ve forced traditional pharmacies and insurers to lower prices. That’s good. But they’re not the answer for everyone. For some, they’re a lifeline. For others, they’re a distraction. The real win? When your insurer finally starts showing you transparent prices. When your pharmacy gives you a printed receipt that says exactly what you paid - not what the PBM billed. Until then, DTC pharmacies are the closest thing we have to a fair deal.Final Thought

You don’t need to abandon your insurance. You just need to know when to ignore it. If your blood pressure pill costs $45 with insurance and $8 online - take the $8. If your diabetes med costs $10 with insurance and $15 online - stick with your card. It’s not about being anti-insurance. It’s about being smart. The system is messy. But you don’t have to be.Are DTC pharmacies safe?

Yes - if you stick to major, well-known platforms like Amazon Pharmacy, Costco, Walmart, and Mark Cuban Cost Plus Drug Company. These companies are licensed, use U.S.-based pharmacists, and source drugs from FDA-approved suppliers. Avoid unknown websites that don’t require a prescription or offer prices that seem too good to be true. If it’s not on the list of verified DTC pharmacies, don’t risk it.

Can I use DTC pharmacies if I have Medicare?

You can, but you shouldn’t automatically assume it’s better. Medicare Part D plans already negotiate low prices for generics. For most people, using your plan’s pharmacy network saves more money than paying cash online - unless you’re hitting your coverage gap (the donut hole). If you’re in the donut hole, DTC pharmacies can be a lifesaver. Always compare your plan’s price to DTC prices before switching.

Why don’t DTC pharmacies carry all medications?

Because they’re businesses, not full-service pharmacies. They focus on high-volume, high-savings drugs where they can compete on price. Rare or low-demand medications - especially complex ones like specialty injectables or hormonal therapies - aren’t profitable to stock. They don’t have the inventory space or the supply chain for every possible drug. That’s why one in five expensive generics aren’t available anywhere online.

Is GoodRx better than DTC pharmacies?

GoodRx isn’t a pharmacy - it’s a price comparison tool. It shows you cash prices at local pharmacies and sometimes links to DTC options. It’s useful for finding the lowest price in your area, but it doesn’t sell drugs. For true savings on expensive generics, going directly to Amazon or Mark Cuban’s site often gives you a better price than what GoodRx lists for local stores.

Should I switch all my prescriptions to DTC pharmacies?

No - unless you’ve checked each drug individually. Switching everything blindly could cost you more. Some drugs are cheaper with insurance. Others aren’t even available online. Plus, managing multiple accounts, shipping times, and refill schedules can become a burden. Only switch the ones where you’re saving $20 or more per month - and make sure you can reliably get them on time.

10 Comments

Jamie Watts

November 14, 2025So let me get this straight you’re telling me I should check five different websites every month just to save $12 on lisinopril? That’s not saving money that’s paying in stress points

Diane Tomaszewski

November 15, 2025I just go to Costco and walk in. No login no app no comparing prices. My metformin is $7. That’s it. Why make it harder than it needs to be

Oyejobi Olufemi

November 16, 2025YOU’RE ALL MISSING THE POINT!!! This isn’t about pills or copays-it’s about the systemic collapse of healthcare capitalism!! The PBMs are VAMPIRES feeding on the blood of the sick while Amazon and Mark Cuban play the role of ‘benevolent’ corporate band-aids!!! They don’t care about you-they care about market share and PR!!! The real solution is single-payer!!! But noooooo we’d rather play price-tag whack-a-mole with our insulin!!!

Deepak Mishra

November 16, 2025OMG I JUST REALIZED I’VE BEEN PAYING $45 FOR MY BP MED FOR 2 YEARS!!! 😱 I’M GOING TO COSTCO TOMORROW!!! 🙌🙏😭 I’M SO EMOTIONAL THIS IS A LIFE CHANGER!!!

David Rooksby

November 17, 2025Look I’ve been reading this stuff since 2021 and I’ve got a spreadsheet with 47 different generic drugs and their price fluctuations across 12 platforms including obscure ones like Rite Aid’s private label and that one pharmacy in Nebraska that only ships via USPS and charges $1.99 for ‘handling’-and let me tell you the real conspiracy isn’t the PBMs it’s that the FDA allows these DTC companies to import bulk generics from India without full batch testing and then slap a ‘USP Verified’ label on it because they’re lobbying the same people who used to work at Express Scripts and now sit on the FDA advisory board so yeah I’m not buying the ‘transparency’ narrative one bit

Teresa Smith

November 18, 2025For anyone feeling overwhelmed by this-start with one medication. Just one. Compare your insurance copay to Costco’s cash price. If it’s not better, leave it. If it is-switch. Then do the next one next month. You don’t have to fix everything today. Progress over perfection. You’re doing better than you think.

ZAK SCHADER

November 19, 2025Why are we even letting foreign drug factories supply our meds? This is why America is weak. If we had real manufacturing here none of this would be an issue. Just buy American. End of story.

Melanie Taylor

November 20, 2025Costco is the real MVP 🥹💖 I got my thyroid med for $3.50 last week and the pharmacist gave me a free lollipop!! 🍭 I’m crying happy tears!!!

John Mwalwala

November 20, 2025There’s a hidden layer here nobody’s talking about-the supply chain fragmentation. DTC pharmacies are operating on gray-market allocations that bypass the traditional PBM-tiered distribution. This creates arbitrage opportunities but also introduces regulatory risk. If the DEA or FDA cracks down on bulk sourcing from non-licensed wholesalers, you could see sudden discontinuations. The ‘low price’ is a temporary artifact of regulatory arbitrage, not sustainable pricing. You’re not saving money-you’re gambling on bureaucratic inertia.

Dan Angles

November 20, 2025Thank you for this comprehensive and well-researched post. I would like to emphasize that while price comparison tools are valuable, they should be used in conjunction with consultation from a licensed pharmacist. Your health is not a commodity to be optimized for savings alone. Always verify the authenticity of the source, confirm drug interactions, and ensure continuity of care. The goal is not merely cost reduction-it is sustainable, safe, and informed health management.