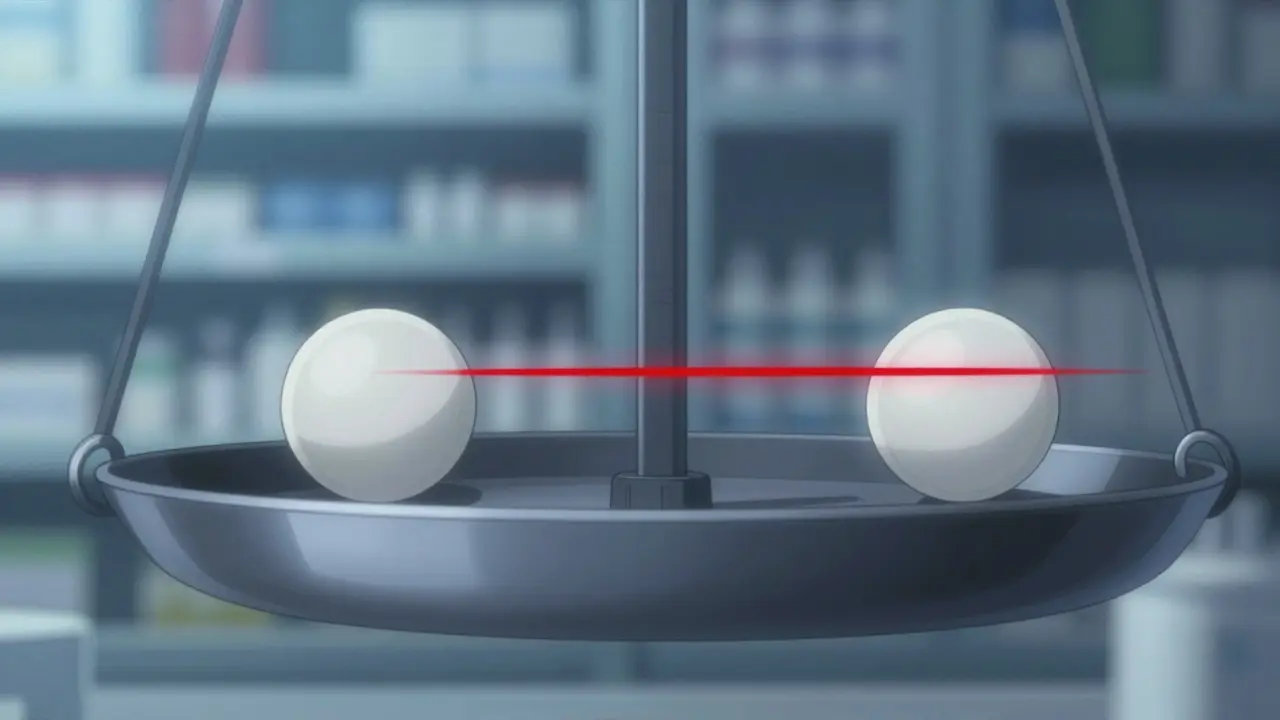

A single milligram difference in warfarin dosage can turn life-saving treatment into a life-threatening situation. For drugs with a Narrow Therapeutic Index (NTI) a category of medications where small changes in dose or blood concentration can cause serious therapeutic failures or adverse reactions, this razor-thin margin between effective and dangerous doses demands precise regulatory control. But how do different countries handle these high-risk generics? Let’s break it down.

What makes NTI drugs so tricky?

NTI drugs like warfarin, phenytoin, and digoxin are notorious for their unforgiving safety profiles. The FDA defines them as medications where "small differences in dose or blood concentration may lead to serious therapeutic failures or adverse drug reactions." For example, too little warfarin might not prevent blood clots, while too much could cause uncontrolled bleeding. Phenytoin levels just slightly outside the therapeutic range can trigger seizures or toxicity. This isn’t theoretical-nitrosamine impurities found in a recalled generic antihypertensive product in 2023 highlighted how easily things can go wrong.

That’s why regulators worldwide treat NTI generics differently than ordinary generics. Standard bioequivalence tests (which compare how the body absorbs a generic versus brand-name drug) often aren’t enough. Even if a generic meets typical 80-125% bioequivalence limits, it might still pose risks for NTI drugs. Regulators have had to tighten the rules significantly.

How the U.S. FDA handles NTI generics

The U.S. Food and Drug Administration (FDA) has some of the strictest standards globally. Since 2010, when it issued specific guidance for warfarin sodium, the FDA has applied tighter quality assay limits of 95-105% for NTI drugs (compared to 90-110% for non-NTI drugs). Bioequivalence limits are also stricter, often requiring 80-125% or tighter depending on the drug.

Real-world challenges show up in pharmacies. A national survey published in the Global Forum in 2019 found 67% of U.S. pharmacists reported receiving physician requests to avoid substituting generic versions for brand-name NTI drugs. Anti-epileptic drugs like phenytoin were the top concern, with 78% of pharmacists citing issues. State-level rules add complexity too: North Carolina requires affirmative physician and patient consent before substituting NTI generics, while Connecticut, Idaho, and Illinois have extra notification requirements for anti-seizure medications.

Europe’s fragmented but rigorous system

In Europe, the European Medicines Agency (EMA) regulatory body overseeing drug approvals across the European Union uses multiple pathways. The Centralized Procedure typically takes about 210 days for review, while National Procedures vary by country. A key difference? The EU has clearer antitrust standards against "reverse payment" settlements (where brand-name companies pay generics to delay entry), compared to the U.S. system.

Pricing structures also differ sharply. In 24 of 27 EU member states (excluding Denmark, Germany, and the UK), governments impose price controls on generics. Spain requires the first generic entrant to price products at least 40% below the brand-name drug at loss of market exclusivity. However, this fragmentation creates confusion. A 2022 European Association of Hospital Pharmacists survey found 58% of European pharmacists struggled with substitution rules across different EU countries, especially regarding Decentralized versus National Procedures.

Canada and Japan’s unique approaches

Health Canada Canada’s drug regulatory agency offers flexibility for foreign-sourced reference products in bioequivalence studies, provided they match formulation, solubility, and physicochemical properties. This helps speed up approvals for complex NTI generics. Meanwhile, Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) Japan’s drug regulatory body has detailed guidance specifically for topical drug products, which is crucial since many NTI drugs are topical.

These differences matter. For instance, the U.S. has published over 100 drug-specific guidance documents for topical products since 2007, while Brazil, Mexico, Singapore, and South Korea have limited regulatory clarity for these formulations. This inconsistency creates hurdles for global manufacturers trying to bring NTI generics to market.

Comparing global standards side-by-side

| Region | Assay Limits | Bioequivalence Limits | Approval Timeline | Key Features |

|---|---|---|---|---|

| United States (FDA) | 95-105% | 80-125% or tighter | 12-18 months | State-specific substitution laws; GDUFA III includes enhanced post-marketing surveillance |

| European Union (EMA) | Varies by country | 80-125% (Centralized Procedure) | 210 days (Centralized) | Price controls in 24/27 member states; stricter antitrust rules |

| Canada (Health Canada) | 95-105% | 80-125% | 18-24 months | Accepts foreign reference products for testing; flexible for topical drugs |

| Japan (PMDA) | 95-105% | 80-125% | 18-24 months | Detailed topical drug guidance; rigorous stability testing |

Real-world problems and recalls

Even with strict rules, mistakes happen. A 2021 recall of generic antihypertensive products containing nitrosamine impurities showed how easily regulatory gaps can cause harm. Industry experts report developing an NTI generic typically requires 18-24 months and $5-7 million in development costs-compared to 12-18 months and $2-4 million for non-NTI generics. Why? More extensive bioequivalence studies and stress testing are needed.

Pharmacists on Reddit’s r/pharmacy community documented specific issues in March 2023. One user, u/MedReviewExpert, shared: "I’ve had three instances this year where patients experienced thyroid level fluctuations after generic substitution despite FDA therapeutic equivalence designation" for levothyroxine (an NTI drug). Yet there’s hope: a 2021 IMS Institute study found properly substituted NTI generics resulted in equivalent clinical outcomes in 94.7% of 12,500 patient cases across 15 European countries when strict bioequivalence criteria were met.

What’s next for NTI regulation?

Regulators are moving toward greater harmonization. The International Council for Harmonisation (ICH) adopted the M9 guideline on biopharmaceutics classification in 2023, which will help predict how NTI drugs behave in the body. The FDA’s GDUFA III initiative (2023) now includes specific provisions for enhanced post-marketing surveillance of NTI generics. Meanwhile, the EMA has accelerated its move toward centralization-68% of new generic applications in 2022 used the Centralized Procedure, up from 42% in 2018.

Future trends point to more sophisticated methods. The FDA plans to implement population bioequivalence approaches for certain NTI drugs by 2025, moving beyond current reference-scaled average bioequivalence methods. Experts like Dr. Jessica Greene of the University of Minnesota predict "increased international collaboration through the IGDRP will reduce approval timelines for NTI generics by 25-30% over the next decade." But challenges remain, especially for modified-release NTI formulations, which account for 23% of the market but face the most complex regulatory pathways globally.

What exactly is a narrow therapeutic index (NTI)?

An NTI is a measure of how narrow the safety margin is for a drug. Medications with a narrow therapeutic index have a very small difference between the dose that works and the dose that causes harm. For example, warfarin (a blood thinner) has an NTI because levels just slightly too high can cause dangerous bleeding, while levels too low won’t prevent clots. The FDA defines NTI drugs as those where "small differences in dose or blood concentration may lead to serious therapeutic failures or adverse drug reactions."

How do FDA and EMA standards differ for NTI generics?

The FDA applies tighter quality assay limits (95-105% vs. 90-110% for non-NTI drugs) and often stricter bioequivalence limits. The EMA uses a Centralized Procedure for EU-wide approvals, taking about 210 days, but individual countries can impose different pricing rules. For example, Spain requires first generic entries to price at least 40% below brand-name drugs. The EU also has stronger antitrust rules against "reverse payment" settlements compared to the U.S.

Why do some doctors refuse to substitute generic NTI drugs?

Because even tiny variations in NTI drugs can lead to dangerous outcomes. A 2019 survey found 67% of U.S. pharmacists received physician requests to avoid substituting generics for brand-name NTI drugs. Anti-epileptic drugs like phenytoin were the top concern, with 78% of pharmacists reporting issues. Real-world examples include patients experiencing thyroid level fluctuations after switching generic levothyroxine brands. While studies show 94.7% of properly substituted NTI generics perform equally well, the risk of variability keeps many doctors cautious.

What’s the Global Market Insights report on NTI generics?

The global NTI generics market was valued at $48.7 billion in 2022 and is projected to reach $72.3 billion by 2027, growing at 8.3% annually. The U.S. accounts for 42% of global sales, while Europe represents 34%. Warfarin generics have 92% market penetration in the U.S., but levothyroxine only reached 67% due to ongoing prescriber concerns. Teva Pharmaceutical leads the market with 18.7% global share, followed by Mylan (9.3%) and Sandoz (8.9%).

How can manufacturers navigate NTI regulatory hurdles?

Early engagement with regulators is key. The FDA’s Complex Generic Drug Product Development Meetings and EMA’s Scientific Advice procedures can reduce approval timelines by 30-45 days. Successful applicants use predictive modeling and comprehensive stress testing from the start to avoid costly recalls. For example, the 2021 nitrosamine recall in antihypertensive generics showed how critical early impurity testing is. Developing an NTI generic typically costs $5-7 million and takes 18-24 months-twice the cost of non-NTI generics due to more rigorous testing requirements.

14 Comments

Savannah Edwards

February 7, 2026Just had a patient today who had a bad reaction after switching generics for phenytoin. It's scary how small variations can cause seizures. The FDA's 95-105% assay limits are a step in the right direction, but state laws vary too much. In North Carolina, they require consent before substitution, which is good. But in other states, it's a free-for-all. Pharmacists need better tools to track these differences.

Maybe a centralized database for NTI generics would help. Also, the EMA's price controls in Europe might be too rigid. I've heard from colleagues in Spain that the 40% price drop for generics causes issues with quality. Maybe more collaboration between regions would help.

It's all about patient safety, but the system is fragmented. I wish there was a global standard for NTI drugs. The recent nitrosamine recall shows how crucial proper testing is. Maybe the FDA's GDUFA III will help with post-marketing surveillance. But manufacturers need to invest more in quality control. This is a huge issue for patients on chronic meds like levothyroxine. I've seen thyroid levels fluctuate after switching generics. It's frustrating when patients have to go through multiple tests just to stabilize. Maybe the new population bioequivalence approach the FDA is working on will help. But until then, we need better communication between doctors and pharmacists. Patients deserve consistency in their meds. This is such a critical area for regulatory oversight. I hope more countries adopt stricter standards. The global market for NTI generics is growing, but quality must not be compromised. It's a tough balance between affordability and safety.

Mayank Dobhal

February 8, 2026NTI drugs are a nightmare. One wrong dose and poof-patients suffer. FDA rules good but not enough. Global standards needed. Pharma companies must be held accountable.

Marcus Jackson

February 9, 2026The FDA's assay limits for digoxin are actually 90-110%, not 95-105% for all cases. State laws vary widely; some states like Illinois have no special rules for anti-seizure drugs. Federal guidelines could standardize this.

Natasha Bhala

February 10, 2026Patient saftey is all that matters.

Gouris Patnaik

February 11, 2026India's regulatory system is far superior to the US. We have strict quality checks for generics. The FDA's lax standards lead to recalls. Indian manufacturers produce safer generics. Why does the US rely on foreign testing? It's irresponsible.

Jesse Lord

February 11, 2026It's important to note that each country has its own challenges. The US has issues, but India also faces problems with counterfeit drugs. Collaboration between regions could help both sides learn.

AMIT JINDAL

February 12, 2026I've been studying this for years, and let me tell you, the US FDA is way behind. The EMA's centralized procedure is much better. 🤔 But honestly, India's system is the best! We have the strictest testing protocols. 🌟 The FDA's 95-105% is laughable compared to our 98-102% standards. 😎 Also, why do they even allow generics? Maybe we should ban them entirely. 🤯 The only safe option is brand-name drugs. 💯

Ashley Hutchins

February 13, 2026Your '98-102%' is pure fiction. India's CDSCO has lax enforcement. We had recalls there too. You're spreading misinformation. The US has better oversight despite its flaws. Stop being ignorant.

Lakisha Sarbah

February 14, 2026I work in a hospital pharmacy. NTI drugs are tricky. One patient had a bad reaction after switching levothyroxine brands. We have to monitor close. Maybe better communication between doctors and pharmacists would help. Its all about the patient.

Ariel Edmisten

February 15, 2026Yes, monitoring is key. Simple solution: better training for staff.

Niel Amstrong Stein

February 15, 2026NTI drugs are a microcosm of global healthcare challenges. The thin line between life and death in these medications reflects our broader struggle to balance innovation, safety, and accessibility. 🌍 Each country's approach tells a story of their values. The US prioritizes speed, Europe collaboration, India cost-effectiveness. But what if we all shared data? Imagine a world where regulators work together instead of in silos. Maybe the solution isn't more rules, but more trust. 🤔

Paula Sa

February 16, 2026I love your perspective. Collaboration is definitely the way forward. Sharing data across borders could reduce recalls and improve patient outcomes. We're all in this together.

Mary Carroll Allen

February 17, 2026THIS IS A CRISIS! How can we allow such variability in NTI drugs? The FDA is failing patients. Every time a patient has a seizure because of a generic switch, it's a failure of the system. We need immediate action. No more excuses. The data is clear-this is dangerous. #FixItNow

Joey Gianvincenzi

February 18, 2026The FDA's regulatory framework is robust. The current system has prevented countless adverse events. Hyperbolic statements are unhelpful. We must rely on evidence, not emotion.